Choosing the right legal structure is one of the most important decisions any startup or business can make. Among the various types of business structures, the Public Limited Company (PLC) stands out for its unique features, advantages, and challenges.

In this article, we’ll explain to you what a PLC is, compare it with other company types, and the key advantages and disadvantages of public limited company.

What is the meaning of a Public Limited Company?

A publicly traded company is a form of capital organization used by large corporations. Each partner is responsible to the extent of the number of shares he owns, and if we look at the advantages and disadvantages of public limited company, we will find that participation in it takes place with a high level of financial security.

While its establishment requires relatively high capital, it enjoys a solid legal structure and credibility in the business world.

Advantages and Disadvantages of a Public Limited Company

Choosing the right legal structure is one of the most critical decisions for any startup or growing business. The choice depends on various operational, legal, and tax considerations. Among the available options, a Public Limited Company (PLC) offers both significant benefits and notable challenges.

Below, we review the most important advantages and disadvantages of public limited company:

10 Advantages of Public Limited Company

Here are the top reasons why many businesses choose to set up a public limited company:

1. Easier Access to Big Capital

Going public means you can raise money from the stock market, which makes it much easier to secure large investments to grow your business faster.

2. Limited Personal Risk

As a shareholder, you’re only responsible for what you’ve invested, as your savings and property are protected from company debts.

3. Boosted Credibility

Being a PLC gives your business a serious reputation upgrade. Investors, banks, and customers often feel more confident working with a public company.

4. Greater Public Awareness

Listing your company on the stock exchange means more visibility, which often leads to more business opportunities and brand recognition.

5. Shares Are Easy to Buy and Sell

Because shares are publicly traded, they can be bought or sold with ease. This flexibility makes investing in your business more attractive to others.

6. Attracting Top Investors and Talent

Want serious investors and skilled executives on board? A PLC structure gives you the tools to offer competitive stock options and investment potential.

7. Continuity and Stability

The company remains operational regardless of changes in shareholders, ensuring long-term business stability.

8. Room to Scale Up

With better funding and structure, PLCs can grow rapidly, whether it’s expanding into new markets or investing in advanced technology.

9. Professional Management

Ownership is separate from day-to-day management, which means your company can benefit from experienced leaders running the show.

10. Ready for Global Growth

A PLC structure sets you up to think big, as it’s ideal for entering international markets or exploring mergers and acquisitions.

5 Disadvantages of Public Limited Company

1. High Setup and Operational Costs

Establishing a PLC involves considerable legal, administrative, and compliance expenses compared to other company types.

2. Higher Capital Requirements

There is a statutory minimum share capital requirement, which is usually higher than that of limited liability companies.

3. Complex Corporate Governance

The need for a board of directors and supervisory structures increases operational complexity and management costs.

4. Ongoing Regulatory Obligations

Public Limited Companies must follow detailed financial regulations, including regular audits and public disclosures, which can be resource-intensive.

5. Reduced Shareholder Influence

Due to the scale and structure of PLCs, individual shareholders often have limited direct control over day-to-day operations.

After understanding the pros and cons of a Public Limited Company, let’s now look at how it stands apart from other business types.

Comparing PLCs to Other Business Structures

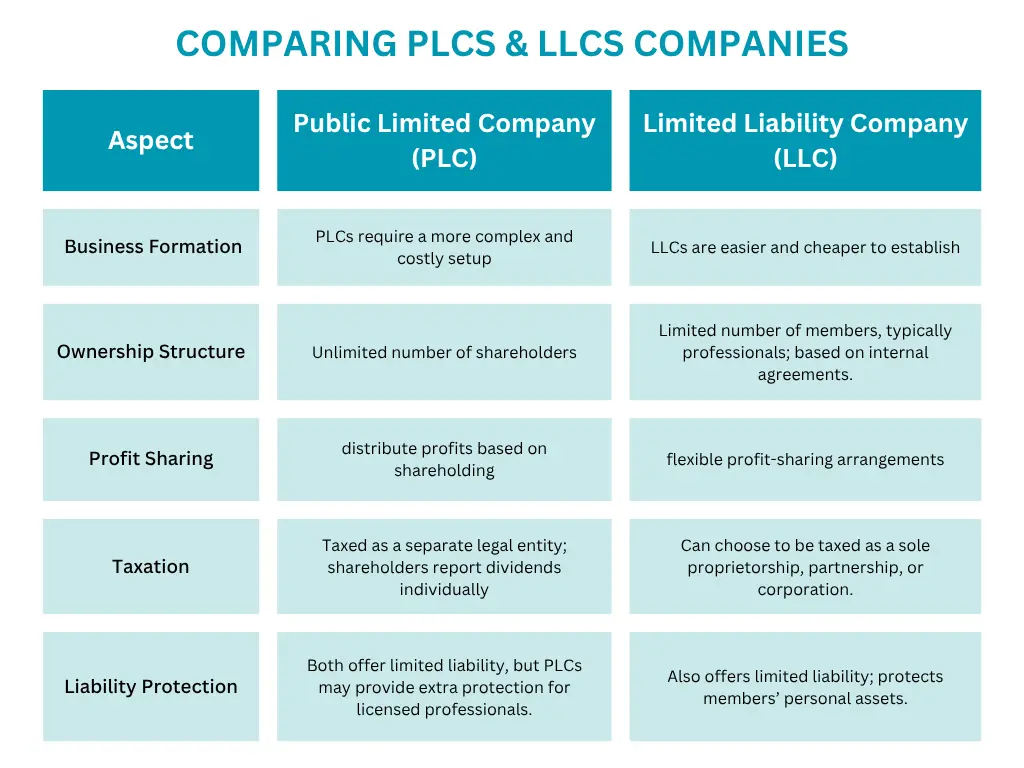

In addition to understanding the advantages and disadvantages of Public Limited Company, it’s important to compare it with other business structures, particularly Limited Liability Companies, to make a well-informed decision. Here’s a closer look at those differences:

1. Business Formation

The process of establishing a PLC differs from that of a Limited Liability Company:

- PLC: Requires a detailed incorporation process, including approved documents, a minimum share capital, and compliance with specific legal and regulatory standards.

- LLC: Generally involves a simpler registration process with fewer legal formalities and lower capital requirements.

2. Ownership or Membership Structure

- PLC: Allows for an unlimited number of shareholders, including individuals and institutional investors.

- LLC: Typically involves a limited number of members, often professionals in a specific field, with membership based on internal agreements.

3. Profit Sharing

- PLC: Profits are distributed proportionally to share ownership.

- LLC: Profit distribution is flexible and can be determined by mutual agreement among the members, regardless of ownership percentage.

4. Taxation

- PLC: Taxed as a separate legal entity. Shareholders report dividends on their personal tax returns.

- LLC: Offers more flexibility and can choose to be taxed as a sole proprietorship, partnership, or corporation, depending on the structure and jurisdiction.

5. Liability Protection

- Both PLCs and LLCs provide limited liability protection, meaning owners are not personally responsible for business debts.

- PLCs may offer additional liability protection for licensed professionals, insulating them from legal issues caused by the actions of other shareholders.

By comparing these key factors (formation, ownership, profit sharing, taxation, and liability), you can determine which structure best fits your business goals, size, and industry requirements.

How can Alexzone help you in setting up a Public Limited Company?

Thinking of starting a Public Limited Company or converting your LLC into a more advanced business structure?

Whether you’re looking for a business setup in Dubai UAE, or need expert guidance on company formation, we’re here to support you every step of the way. With our extensive expertise in legal restructuring and compliance, Alexzone offers comprehensive services to help you achieve your business goals with confidence and security.

Contact us today to find the ideal structure for your business success!

Conclusion

Understanding the advantages and disadvantages of a public limited company is essential before choosing this legal structure. While it offers significant benefits such as limited liability, access to capital, and public credibility, it also comes with higher costs and stricter regulatory obligations.

Businesses should carefully assess their goals, resources, and long-term vision when deciding to set up a public limited company.

Frequently Asked Questions

1. Can a Limited Liability Company (LLC) be Converted into a Public Limited Company (PLC)?

Yes, an LLC can be converted into a PLC by submitting amendment documents and necessary transfer forms to the relevant authorities. In some cases, additional licenses or certifications may be required, especially for professionals seeking to establish a publicly traded company.

2. What is the Cost of Establishing a Public Limited Company?

The cost of setting up a PLC varies by country or region and typically includes:

- Legal and accounting fees

- Registration and government filing fees

- Licensing and compliance costs

In many jurisdictions, establishing a PLC is more expensive than forming an LLC due to higher capital requirements and additional regulatory conditions.

3. How Can I Dissolve a Limited Liability Company?

To properly dissolve an LLC, the following steps are usually required:

- Submit dissolution documents to the competent authorities

- Notify creditors and settle outstanding debts

- Distribute remaining assets to members

- Consult legal and financial experts to ensure full compliance and avoid future liabilities.

For a free consultation, contact us now and let us help you choose the best for your project.

Leave Your Comment